Personal finance products present a paradox. As a topic, personal finance is deeply emotive, yet digital products in the space are little more than million-button ATMs. They are laser-focused on delivering incremental functional benefits — more features, more basis points, more visualizations — to the point of emotionlessness.

What’s more, as unprecedented levels of financial anxiety create knock-on effects on mental health, interpersonal relationships and productivity in the US and beyond, the notion that financial services firms should design for customers’ psycho-emotional satisfaction begins to look like a need, not simply a nice-to-have. And this need appears even more urgent when we consider that younger generations are increasingly turning away from the traditional financial services system in favor of alternative means to manage, save, and invest their money.

So, what is to be done? How might we offer consumers more emotionally resonant product experiences, and ultimately make acquisition, retention and advocacy more than a matter of comparing APYs?

At ustwo, we approach user needs through the lens of Play Thinking, a philosophy that takes a more holistic view of product problems than traditional design thinking. The twin conceptual currencies of Play Thinking are “jobs to be done” and “joy to be had.” In practice, this means that we treat emotional responses as key outputs of the design process. Specifically, we identify and reverse-engineer desirable emotional states to yield products that not only help users achieve functional outcomes, but that are experientially meaningful, rewarding, and even fun.

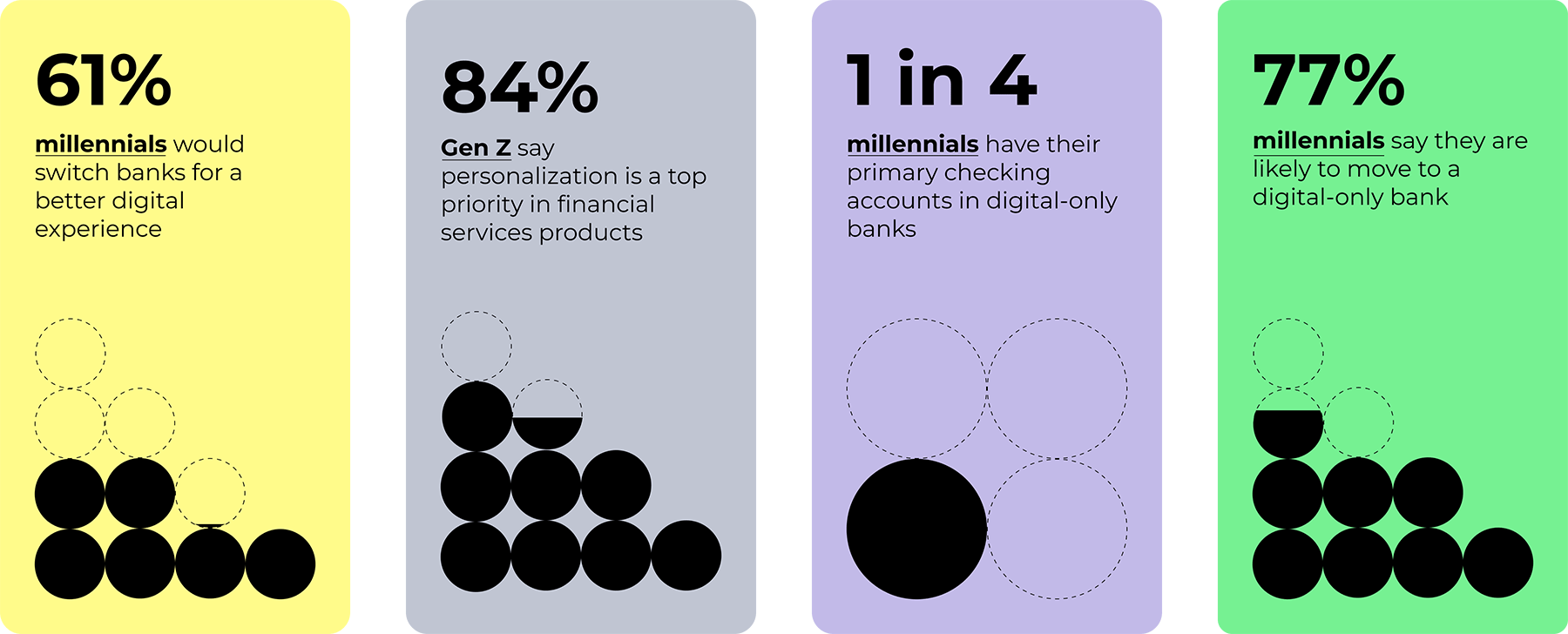

Which functional financial outcomes could benefit from the application of Play Thinking? Day-to-day money management, long-range planning, education and advisory services are all ripe for disruption, but in this article we’ll focus on two main areas of concern. The first centers on the challenge of motivating and empowering consumers, particularly millennials and Gen Z, to take a more active role in securing their financial futures. The second relates to helping them explore, express and act upon ethical dimensions of their financial attitudes and aspirations, with the goal of “winning” with that fast-growing segment of consumers.

Play can help consumers “feel their futures”, transforming detachment into excitement.

It’s well-established that consumers generally do not have enough money saved or invested to safeguard their financial futures. In the context of persistently high consumer spending, why is this the case, and what can firms do to get consumers engaged with their financial futures?

In line with our Play Thinking philosophy, let’s examine the emotional undercurrents of surface-level trends. Take the millennial- and Gen Z-driven appetite for high-risk alternative investments, most notably cryptocurrency, early-stage startups and meme stocks. An uncharitable analyst of this phenomenon might dismiss it as “get rich quick” speculation, fueled by self-appointed social media “finfluencers” vying to pull attention and investment away from traditional financial institutions. But the emotional reality is deeper, not to mention more actionable.

These millennials and Gen Zers are operating according to (generally accurate!) perceptions that mainstream financial services providers are not set up to serve their unique life trajectories nor their disproportionately more ESG-oriented investing preferences. Those nonstandard trajectories and preferences are themselves a product of how millennials’ and Gen Z’s life prospects are, overall, dimmer than previous generations’. As they see more and more articles chiding them for not saving enough or marveling at how much more wealth Baby Boomers had accumulated at the same age, these perceptions have a tendency to manifest in one of two ways.

The first way is hail mary desperation: the consumer adopts a “go big or never own a home” mentality and starts betting on high-risk, high-reward investments like crypto. (This phenomenon is likely exacerbated by the techno-cultural shift towards instant gratification and declining attention spans.) The second manifestation is future-rejection: dismayed by their seemingly overwhelmingly bleak prospects, the consumer prioritizes “living in the moment” to the exclusion of long-term thinking or planning.

Play can imbue complex or abstract financial concepts with emotional weight to motivate action.

The challenge, then, is to help the consumer reframe and (re)claim their “future.” This entails them building concrete emotional bonds with two abstract concepts: their future self and their future world. Bonding with the future self creates ties of reciprocity and recasts saving as “self-growth” rather than “self-denial”. Envisioning the consumer’s future world and celebrating their contributions to its realization creates opportunities to “pull forward” validation of their smart financial choices from the future into the present, making long-termist behavior feel urgent, yes, but also immediately rewarding.

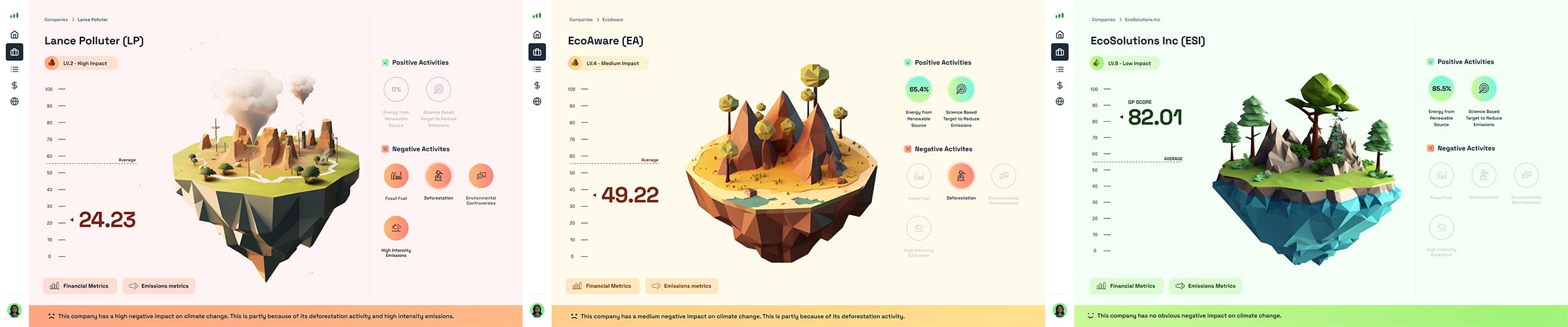

Our work with GreenPortfolio, an environmental investing startup targeted at younger generations, exemplifies this “feel your future” Play Thinking approach. The emotional urgency of proprietary sustainability metrics is heightened with evocative visualizations of your portfolio’s environmental impact, from smoke stacks to flowing rivers. Your investment choices literally “change your world”, helping transform anxiety about the future into a sense of agency and pride at doing your part to live out your principles.

Partly inspired by farming simulation games like Animal Crossing and Stardew Valley — themselves wildly popular with millennials and Gen Z — our work playfully elevated the concept of financial “growth”, taking it in a simultaneously more expansive and more personal direction. Investing is transformed from a dry, cerebral activity into something that feels more like gardening: the careful and rewarding cultivation of a better environment for yourself, both now and in the future.

Conclusion

In this article, we have only scratched the surface of how Play Thinking can be applied to the financial services sector. As impactful as our work with GreenPortfolio undoubtedly is, the investing use case is just one of many in the space whose emotional dimensions are overlooked and underleveraged. From retail banking to insurance, budgeting, advisory and educational services and beyond, the industry is overflowing with opportunities to make customer experiences more evocative and competitive through the application of an emotion-centric design lens that finds the “joy to be had” in the “jobs to be done”.